Message

We at AMMS INTERNATIONAL have developed a variety of businesses revolving around the idea of “Residence,” centering primarily on our domestic subleasing operations, but also featuring other areas such as our real estate services and property management operations. We maximize the synergistic effects of a variety of businesses, including, first and foremost, our real estate business with its core of subleasing, as well as leasing, hotel, and resort businesses, and we intend to topple the status quo of thought in the industry with borderless development going beyond the framework of the traditional real estate industry. By creating new value in the real estate industry, we intend to develop a worldwide business geared for the global stage. This is the vision that we at AMMS INTERNATIONAL aspire to.

Business

Subleasing Business

AMMS supports property owners of foreign nationality considering real-estate leasing business in Japan.

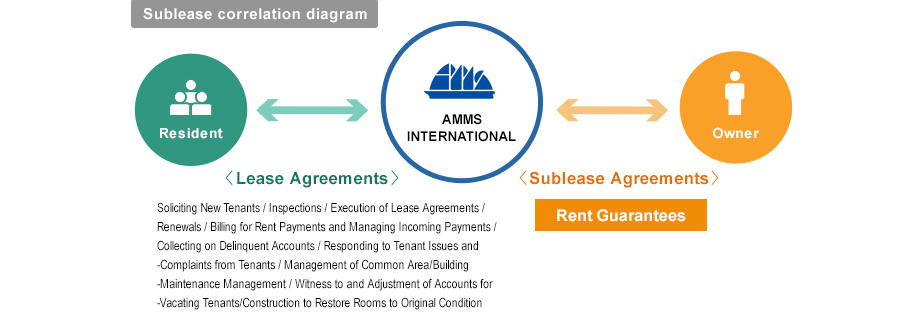

Subleasing refers to a service in which a real-estate company leases rental properties in bulk from the property owner(s), and then, in turn, leases the properties out to tenants. In managing rental properties, owners are constantly plagued by the risks of delinquent rent payments and vacancies. There are also a host of other painstaking administrative tasks such as soliciting new tenants, collecting rent payments, resolving issues, performing building maintenance,adjusting account balances when a tenant moves out, and restoring rooms to their original condition.AMMS INTERNATIONAL takes over all such concerns attendant to rental management, and our subleasing business and Guaranteed Rent System is what allows owners to manage rental properties with stability by guaranteeing their rent income. If you are a property owner of foreign nationality who cannot directly engage in administrative tasks in Japan, rest assured that AMMS has you covered.

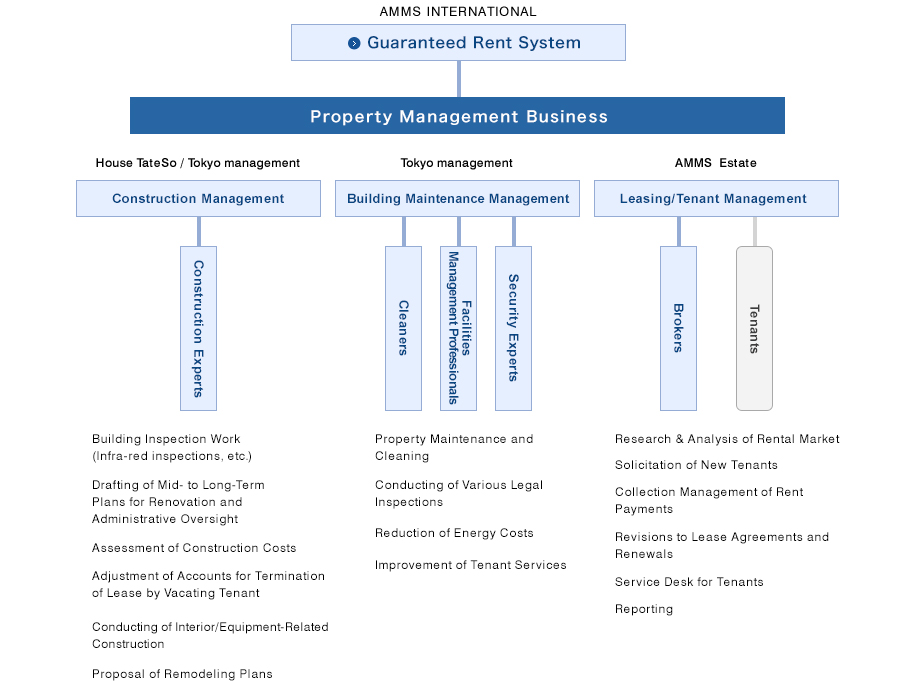

We have cultivated a unique body of knowledge on subleasing ever since we were founded, and we feature comprehensive property management by our group companies.

AMMS INTERNATIONAL has been a pioneer in subleasing for the span of nearly 30 years, developing businesses centered on its subleasing business ever since AMMS was founded in 1986.Our group company holdings of House Kenso, Tokyo Kanri, and AMMS Estate have also enabled us to provide comprehensive property management.

Real-Estate Services Operation

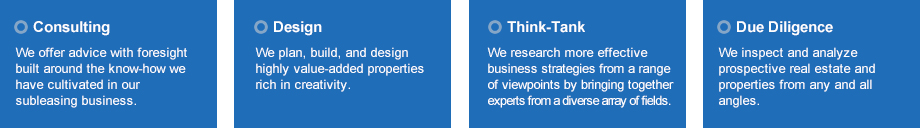

A one-of-a-kind real-estate services and funding operation, leveraging the track record AMMS has built with subleasing.

AMMS INTERNATIONAL’s real estate services operation consist of our “Real Estate Development Operation,” which provides integrated consulting services on investments, sales & purchases, and management of real estate, such as the development, planning, and sale of profitable apartment buildings for investment. In addition, our real estate services operation also consists of our “Securitization Operation,”in which we provide investors with stable and secure, high-return investment opportunities by issuing rights connected to real estate as securities, liquidizing bonds, and distributing risk. The know-how AMMS INTERNATIONAL has cultivated over the years in its subleasing business is what enables us to provide property owners and investors with stable and secure business opportunities.

Real Estate Development Operation

Organizational abilities stemming from our track record and experience as a trusted consultant to investors and property owners.

Spot-on advice and trustworthy consulting, brought to you by AMMS INTERNATIONAL, the company that has learned the ins-and-outs of real-estate management through its experience and achievements in subleasing spanning nearly 30 years. AMMS makes the best, most ideal partner to anyone considering a real-estate investment business.

Securitization Operation

To all investors of foreign nationality considering real estate investments in Japan,

The securitization of real estate that has been garnering attention over recent years is a system of fund-raising from investors by turning real estate operating profits ? such as rent payments of leased housing and gains from sale ? into securities backed by the asset value held by such real estate. The most important thing when it comes to real estate securities is property management. How prospective real estate will be managed and whether rent income can be collected while maintaining high value are important criteria for investors when making decisions. The achievements accumulated by AMMS INTERNATIONAL over the years in its subleasing business generate maximal synergistic results with its real estate securitization operation.

AMMS INTERNATIONAL’s Securitization Track Record

- Round 1: August, 2002

-

Purchase of two hotel buildings in Tokyo (Hamamatsu-cho and Omori).

Acquired S&P and Fitch credit ratings (AA & BBB) and issued 3.4 billion JPY worth of asset-backed securities (ABS) on the Luxembourg Stock Exchange. - Round 2: April, 2003

-

Structured a real estate investment resale fund of 3.4 billion JPY (non-recourse and equity investments) on

April 30, 2003 around four apartment buildings with single-room apartments (Higashi-Shinjuku, Higashi-Kanda,

Ryogoku, and Monzennaka-cho, Botan) developed and constructed by AMMS.

Completed recovery of 100% of principal and achieved an upper limit dividend yield of 8%. - Round 3: March, 2004

-

Structured a real estate investment resale fund of 5.14 billion JPY around three purchased compact-size

apartment buildings (Shibuya-Sanchome, Hatchobori-I, and Hatchobori-II) and one apartment building with

single-room apartments (Ote-Machi) developed and constructed by AMMS.

Using non-recourse and equity investments, completed recovery of 100% of principal and achieved the upper limit dividend yield of 8%. - Round 4: January, 2005

-

Structured small-lot real estate investments under a real estate specified joint enterprise.

(Target real estate: AMMS Higashi-Shinjuku,operation scale of 2.2 billion JPY)

Completed recovery of 100% of principal and achieved an upper limit dividend yield of 5.6 percent. - Round 5: January, 2008

-

Structured small-lot real estate investments under a real estate specified joint enterprise

(Target real estate: AMMS Building No. 2, operation scale of 490 million JPY)

Completed recovery of 100% of principal and achieved an upper limit dividend yield of 5.6 percent. - Round 6: January, 2011

-

Structured small-lot real estate investments under a real estate specified joint enterprise.

(Target real estate: AMMS Building No. 2, operating scale of 490 million JPY)

Completed recovery of 100% of principal and achieved an upper limit dividend yield of 5.8%. - Round 7: January, 2014

-

Structured small-lot real estate investments under a real estate specified joint enterprise.

(Target real estate: AMMS Building No. 2, operation scale of 490 million JPY)

*Expiration of investment scheduled for December 31, 2016

Current estimates forecast 100% recovery of principal and an upper limit dividend yield of 5.8%. - Round 8: Solicitation for investments began in November, 2014

-

Structured small-lot real estate investments under a real estate specified joint enterprise.

(Target real estate: AMMS Amitie Kawasaki, operation scale of 540 million JPY)

*Expiration of investment scheduled for October 31, 2017

Current estimates forecast 100% recovery of principal and dividend yields of 3.5-3.6%.

Fund Operation

AMS-Amitie Kawasaki

- Operation Summary

-

Contributions5 million JPY/lot (Separate processing fee of 1.00% and separate consumption

tax apply)

Yield3.5-3.6% year-on-year for preferred contributions (estimated)

Payment of DividendsTwice per year (June 30, December 31)

ExpiresOctober 31, 2017

RedemptionAllowed (however, a processing fee of 3.00% and separate consumption tax apply) - Property Overview

-

Location21-26 Minami-cho, Kawasaki Ward, Kawasaki-shi, Kanagawa

StreetAddress: 21-26

TypeLodging

ConstructionSteel-enforced concrete, deck roof, seven storeys

Surface Area1st Floor 61.42m2

2nd Floor 80.29m2

3rd Floor 80.29m2

4th Floor 79.57m2

5th Floor 79.57m2

6th Floor 79.57m2

7th Floor 79.57m2

Completion: May 9th, 2014 (New building)

OwnerAMMS INTERNATIONAL Co., Ltd.

1-15-12 Higashi-Ikebukuro, Toshima Ward, Tokyo-to

CONTACT

If you are a property owner of foreign nationality considering systematic asset management and a stable real estate income in Japan, feel free to contact us at AMMS INTERNATIONAL.

Company Overview

| Company Name | AMMS INTERNATIONAL Co., Ltd. |

|---|---|

| Headquarters | 1-15-12 Higashi-Ikebukuro, Toshima Ward, Tokyo-to |

| Founded | November, 1986 |

| Capital | 100,000,000 JPY |

| Representative | CEO and Board Director, Eisuke Tokuhara |

| Employees | 136 |